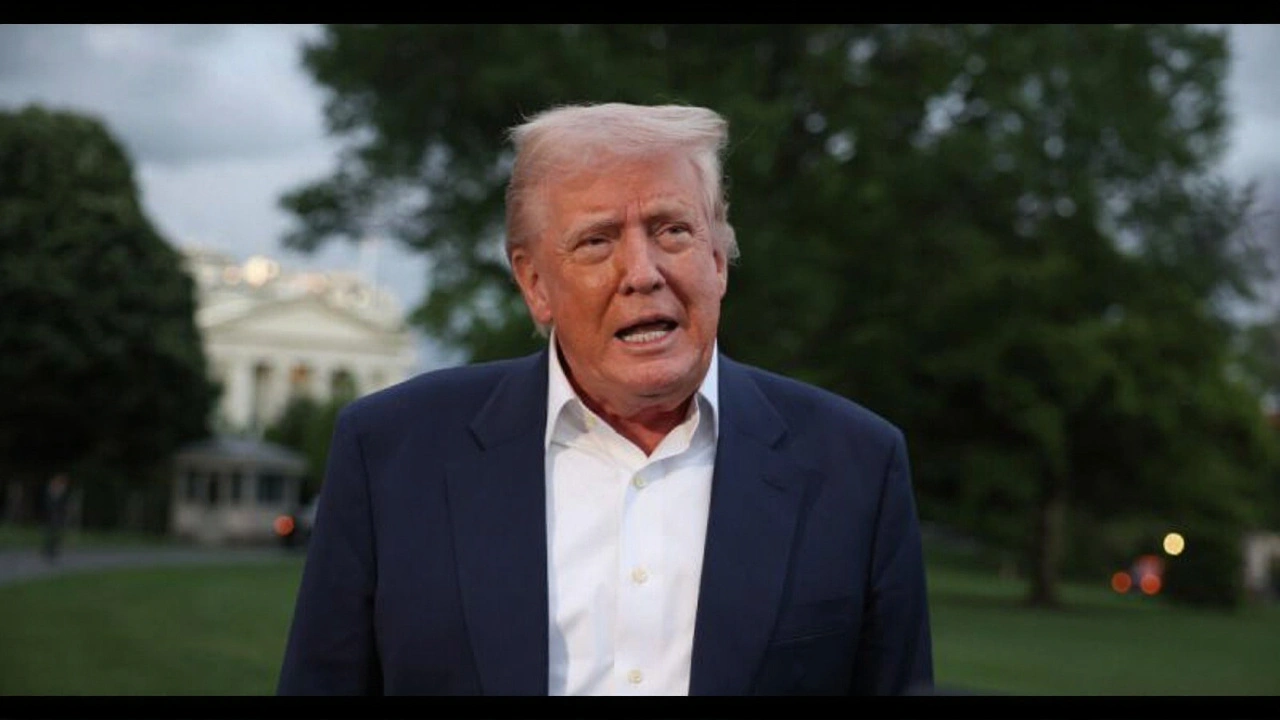

Trump Urges Fannie Mae, Freddie Mac to Push Builders on 2 Million Idle Lots

Trump urges Fannie Mae and Freddie Mac, led by Bill Pulte, to push big builders to develop 2 million idle lots amid a deepening housing shortage.

When you hear Freddie Mac, a government‑sponsored enterprise that buys, guarantees and securitizes U.S. mortgage loans. Also known as Federal Home Loan Mortgage Corporation, it helps keep mortgage rates stable and credit flowing to homebuyers.

Another key player is mortgage loan, the primary tool for buying a house, typically funded by banks and then packaged for investors. Home loan. Together with Fannie Mae, the other large GSE that buys and guarantees mortgages, they form the backbone of the secondary mortgage market. The two entities operate side by side: Freddie Mac focuses on conventional loans from smaller lenders, while Fannie Mae works more with larger banks. A third related entity is the U.S. housing market, the nationwide system of buying, selling and financing homes that drives economic growth. Its health depends heavily on the liquidity that Freddie Mac and Fannie Mae provide.

Freddie Mac isn’t just a corporate name; it’s a set of rules that shape the loans you might get. For example, the agency’s credit‑score guidelines often dictate the interest rates lenders offer. When Freddie Mac tightens its standards, you’ll see tighter loan conditions across the board. Conversely, when it eases up, more people qualify for affordable mortgages, which in turn fuels the U.S. housing market. This cause‑and‑effect chain is a classic semantic triple: Freddie Mac influences mortgage loan criteria, which affects housing market activity. The agency also works with lenders to develop new products, like low‑down‑payment mortgages, showing that its role extends beyond buying loans—it also guides innovation.

Below you’ll find a mix of recent stories, analyses and data points that dive into these dynamics. From policy shifts at Freddie Mac to comparative looks at Fannie Mae’s portfolio, the collection gives you a snapshot of how these GSEs shape credit access, pricing trends and overall market stability. Keep reading to see how the pieces fit together and what the latest moves mean for borrowers, investors and anyone watching the U.S. housing landscape.

Trump urges Fannie Mae and Freddie Mac, led by Bill Pulte, to push big builders to develop 2 million idle lots amid a deepening housing shortage.