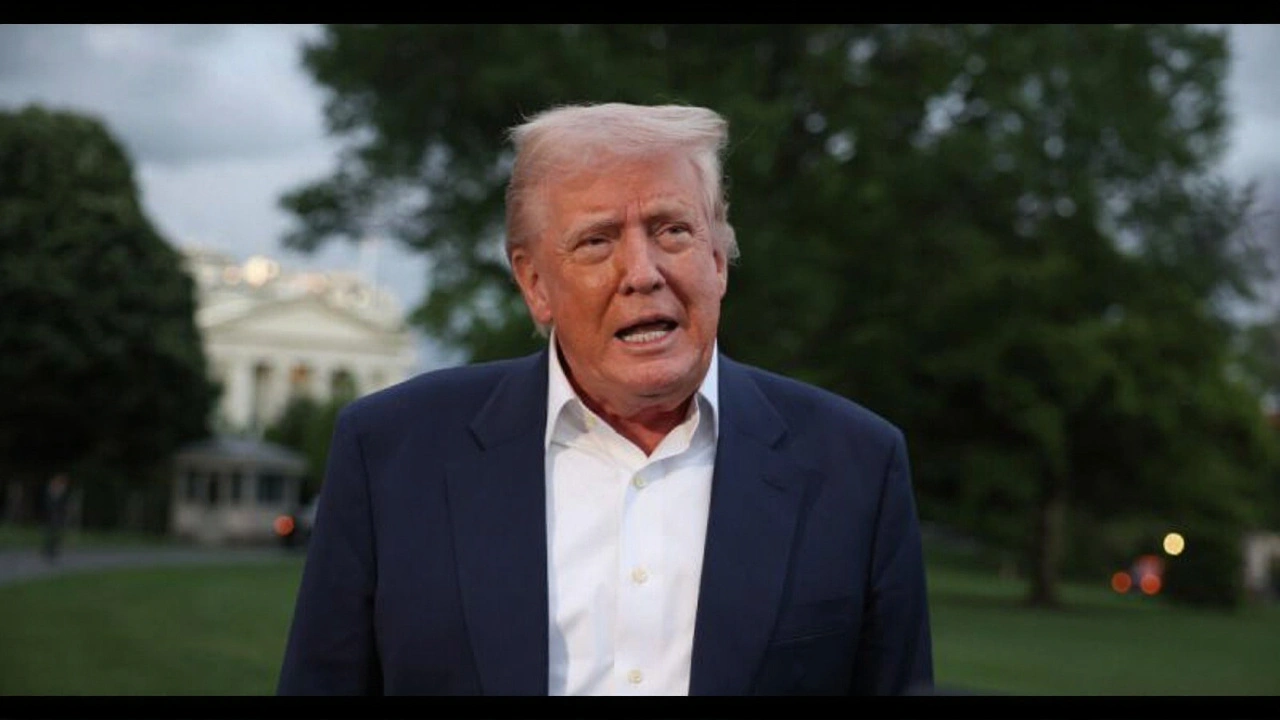

When Donald Trump, former President of the United States posted to Truth Social on October 5, 2025, he blasted big homebuilders for hoarding land and called on the government‑sponsored mortgage giants to force them into gear. He claimed they were sitting on "2 million empty lots, a record," and said that mobilising those parcels could help reverse the nation’s chronic housing shortage. The post quickly went viral, sparking debate in Washington, Wall Street and suburbia alike.

Why the housing market is at a breaking point

The latest data from the U.S. Census Bureau shows just 490,000 newly built homes on the market at the end of August 2025 – the lowest figure for the year and a 1.4 % dip from July. Months‑of‑supply ticked down to 7.4, down from 9.0 in July and well under the 8.2 level recorded a year earlier. Those numbers tell the same story that economists have warned about since the pandemic: inventory is shrinking while mortgage rates hover near 7 %, squeezing would‑be buyers.

Builders such as Lennar and D.R. Horton have tried to keep their pipelines moving by offering rate buydowns through captive lenders like Lennar Mortgage and DHI Mortgage. Yet demand remains tepid; many families can’t afford the monthly payments, and rental prices continue to climb in major metros.

Trump’s "American Dream Restoration" appeal

In the same Truth Social note, Trump linked his demand to the "American Dream Restoration" initiative, an executive order issued in January 2025 that tasks federal agencies with expanding affordable housing. He singled out Fannie Mae and Freddie Mac, whose new chairman is home‑building veteran Bill Pulte, to use their financing muscle to "push big homebuilders into action."

"They're my friends. They're very important to the success of our country," Trump wrote, drawing a controversial parallel between homebuilders and the oil cartel OPEC. "Now that they can get financing, they have to start building homes."

What the mortgage giants can (and can’t) do

Industry analysts quickly reminded Trump that Fannie Mae and Freddie Mac are primarily lenders, not developers. Their mandates focus on providing liquidity to the mortgage market, not directing where or how many homes get built. As (name omitted for brevity) of Goldman Sachs put it, "These GSEs can offer favorable loan terms, but they can’t force a builder to break ground on a vacant parcel."

Nevertheless, the agencies do have levers: they can tighten underwriting standards for loans tied to speculative land, offer lower‑cost financing for projects that meet affordability criteria, and prioritize lenders that work with builders who commit to building in high‑need areas.

- GSEs could expand the Home Affordable Refinance Program (HARP) to cover new‑construction loans.

- They might introduce a "land‑use credit" that rewards developers who sell homes at or below median income levels.

- Both agencies could require a percentage of new‑home financing to be allocated to regions with the most acute supply gaps.

Builders’ perspective: incentives vs. reality

Lennar’s CEO, Stuart Miller, told Bloomberg on October 4 that the company is already stretching its capacity. "We have a pipeline of roughly 30 million acres," he said, "but the economics have to make sense. If the market price doesn’t cover construction costs plus a reasonable return, holding land is the safer bet."

D.R. Horton’s chief financial officer, Jeff Hughes, echoed that sentiment: "We’re not sitting on 2 million empty lots, but we do have parcels that are strategically located far from where demand is strongest. Building in those spots doesn’t solve the affordability crisis and can actually erode profit margins."

Critics argue that the President’s demand for “hundreds of thousands of homes” ignores the fact that much of the idle land sits on the fringe of sprawling suburbs, where jobs, schools and transit are scarce. Housing where people actually want to live – inside established urban cores – is often already owned, not held as vacant farmland.

Potential ripple effects if the GSEs act

Should Fannie Mae and Freddie Mac adopt the tougher land‑use criteria suggested by some policymakers, smaller regional builders could see a sudden surge in available financing. That might translate into a modest uptick in starts, especially in the Midwest and South where land costs are lower.

On the flip side, a rapid shift could strain the GSEs’ balance sheets if a wave of low‑margin loans defaults. The 2022 housing crash taught regulators that overstretching mortgage‑backed securities can destabilise the broader financial system.

For consumers, the biggest hope is that more inventory would bring down listing prices and ease the bidding wars that have become the norm in cities like Austin, Phoenix and Charlotte.

What’s next: policy moves and market watch

Bill Pulte is expected to convene a round‑table with the top five homebuilders and senior officials from the Department of Housing and Urban Development by mid‑November. The meeting will reportedly focus on aligning GSE incentives with the “American Dream Restoration” goals.

Congressional committees on housing and finance have already scheduled hearings for early December to examine the President’s demand and the GSEs’ authority. Lawmakers on the House Financial Services Committee are drafting a bill that would give Fannie Mae and Freddie Mac limited powers to earmark a portion of their loan portfolios for new‑construction projects in designated affordability zones.

Meanwhile, market watchers will be tracking the next few months of builder permits. If the permit data shows a noticeable rise after the GSEs announce new programs, it could signal that Trump’s post has nudged the industry.

Frequently Asked Questions

How could Fannie Mae and Freddie Mac influence homebuilding?

The agencies can tighten loan‑underwriting for speculative land purchases, offer cheaper financing for projects meeting affordability metrics, and require developers to allocate a share of new homes to high‑need regions. While they can’t order builders to construct, the financial incentives can make building more attractive than holding land.

What does the "2 million empty lots" figure refer to?

Trump’s claim aggregates undeveloped parcels reported by industry analysts and county records across the United States. It includes land owned by large builders that has not yet been earmarked for construction, but the exact methodology behind the number has not been disclosed.

Why is the current housing inventory considered low?

At the end of August 2025, only 490,000 newly built homes were on the market, and months‑of‑supply fell to 7.4. By comparison, a healthy market typically shows 6‑8 months of supply. The dip reflects slower construction starts, higher borrowing costs, and lingering pandemic‑era supply chain constraints.

What impact could increased GSE involvement have on home prices?

If more financing reaches builders willing to build in affordability zones, new‑home supply could rise modestly, easing price pressure in hot markets. However, the effect hinges on whether the added homes match local demand locations; mismatched supply could leave prices largely unchanged.

When will Congress act on the President’s housing push?

House and Senate committees have scheduled hearings for early December 2025. Lawmakers aim to introduce legislation that would give the GSEs limited authority to earmark loan funds for new‑construction projects in designated affordability zones, but the bill’s fate remains uncertain.

13 Comments

Sara Lohmaier October 7, 2025 AT 21:53

These builders are just hoarding land for profit.

Sara Lohmaier October 13, 2025 AT 11:53

Fannie Mae can tighten underwriting on speculative land loans and offer lower‑cost financing for projects that meet affordability criteria. 🙂 This helps shift developer incentives without dictating where they must build. It’s a relatively low‑risk tool for the GSEs.

Sara Lohmaier October 19, 2025 AT 01:53

The assertion that 2 million idle lots could instantly resolve the housing shortage overlooks the complexity of land development economics. Builders must evaluate not only acquisition costs but also infrastructural expenses such as utilities, road extensions, and compliance with local zoning ordinances. Moreover, the proximity of these parcels to job centers, schools, and public transit heavily influences their viability for affordable housing projects. In many cases, the so‑called idle land sits on the periphery of sprawling suburbs where demand is fragmented and construction costs rise due to the need for extensive site preparation. Financial incentives from Fannie Mae and Freddie Mac can mitigate some of these hurdles, yet they cannot replace the fundamental requirement for a positive return on investment. The GSEs’ ability to tighten underwriting standards for speculative land purchases may discourage hoarding, but it also risks tightening credit for legitimate developers who lack large balance sheets. Policy designers should therefore consider tiered incentives that reward builders who commit a measurable percentage of units to median‑income households within designated affordability zones. Such a structure could be complemented by a “land‑use credit” that reduces the effective interest rate on loans tied to projects meeting those criteria. Historical data from the 2008‑2012 period shows that similar credit enhancements accelerated the construction of mixed‑income developments in the Midwest. However, the current regulatory environment is more cautious, given the 2022 housing market stress that exposed vulnerabilities in the mortgage‑backed securities market. Any expansion of GSE involvement must be carefully calibrated to avoid a resurgence of risky, low‑margin loans that could strain their capital positions. Regional builders, especially those operating in the South and the Rust Belt, stand to benefit from targeted financing, provided that the programs are transparent and have clear performance benchmarks. Conversely, large national firms may view these measures as a dilution of their market power, potentially prompting legal challenges or lobbying for exemptions. From a consumer standpoint, a modest increase in new‑home supply could alleviate bidding wars in high‑growth metros, but price relief will only materialize if the added units align with buyer preferences for location and amenities. Ultimately, the success of Trump’s proposal hinges less on the raw number of idle lots and more on a coordinated strategy that aligns financial incentives, land‑use planning, and community needs.

Sara Lohmaier October 24, 2025 AT 15:53

I think the GSEs can play a subtle role without overstepping their mandate. The key is aligning incentives with local housing needs.

Sara Lohmaier October 30, 2025 AT 04:53

Wow, another political stunt 🍿. Trump’s “land‑use crusade” sounds like a fairy‑tale for the average family. 🤷♀️ nice try, but the market isn’t that naïve.

Sara Lohmaier November 4, 2025 AT 18:53

Honestly the whole thing is a mess. Yes the GSEs have levers but they cant force builders they just can make loans cheaper and that wont change the profit calculus for developers who sit on land waiting for price spikes. Without real demand the incentives are just a band‑aid and the market will keep ignoring the idle lots.

Sara Lohmaier November 10, 2025 AT 08:53

The United States must prioritize American builders and ensure that foreign policy does not dictate domestic housing. It is imperative that we safeguard national interests in all economic endeavors.

Sara Lohmaier November 15, 2025 AT 22:53

From a financing perspective, the GSEs operate under a secondary‑market paradigm, providing liquidity through securitization pipelines. By adjusting the risk‑adjusted pricing models, they can indirectly influence builder behavior without breaching statutory constraints.

Sara Lohmaier November 21, 2025 AT 12:53

Ah, the paradox of policy!; when we attempt to engineer market outcomes, we must first acknowledge that markets are not merely mechanistic, but rather a tapestry of human choice, cultural nuance, and economic signaling-indeed, each incentive is a thread, and the whole fabric may fray if pulled too aggressively.

Sara Lohmaier November 27, 2025 AT 02:53

It is appropriate to consider the statutory limits of Fannie Mae and Freddie Mac before proposing expanded authority. Any legislative amendment should be crafted with precision.

Sara Lohmaier December 2, 2025 AT 16:53

Looks like another round of talk with no real action. Builders will do whatever makes them money.

Sara Lohmaier December 8, 2025 AT 06:53

From a South‑African viewpoint, the concept of “idle land” is familiar; we have seen similar dynamics where land sits unused, awaiting policy clarity, and indeed, the community impact can be profound-yet, the solution must be rooted in local context, respecting cultural ties, economic realities, and the need for sustainable development.

Sara Lohmaier December 13, 2025 AT 20:53

Great insight! 🌍 It’s crucial we adapt best practices while honoring local nuances. Let’s keep the dialogue constructive. 😊