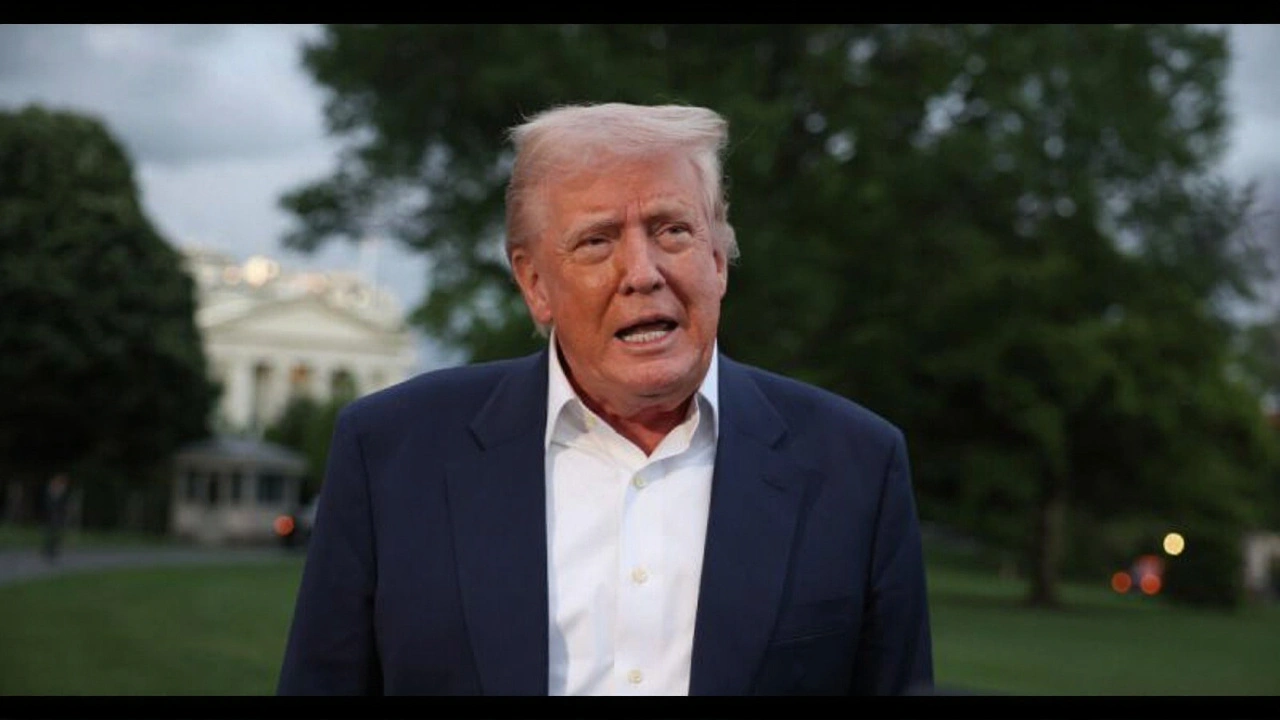

Trump Urges Fannie Mae, Freddie Mac to Push Builders on 2 Million Idle Lots

Trump urges Fannie Mae and Freddie Mac, led by Bill Pulte, to push big builders to develop 2 million idle lots amid a deepening housing shortage.

When you hear Fannie Mae, the Federal National Mortgage Association that buys and securitizes home loans in the United States. Also known as FNMA, it plays a central part in keeping mortgage credit flowing to millions of borrowers.

One of the biggest ways Fannie Mae moves money is through mortgage‑backed securities, bundles of home loans sold to investors. By creating mortgage‑backed securities, Fannie Mae gives banks cash back so they can write new loans—this is the core of the secondary mortgage market. The process enables lenders to offer more affordable rates, and it supports a steady supply of credit for homebuyers across the country.

Fannie Mae doesn’t work alone. Its main competitor, Freddie Mac, runs a parallel system that also purchases and securitizes mortgages. The two entities together cover most of the U.S. mortgage landscape, creating a robust safety net for borrowers and investors alike. This competition influences pricing, service standards, and innovation in loan products.

The entire operation sits under the watchful eye of the Federal Housing Finance Agency, the regulator that oversees Fannie Mae’s capital, risk management, and compliance. FHFA’s oversight ensures that Fannie Mae maintains enough capital to absorb losses, protecting the broader financial system. This regulatory link requires strict reporting and adherence to federal housing policy goals.

For everyday homebuyers, Fannie Mae’s work shows up in the form of lower down‑payment options, more flexible credit criteria, and loan programs like the Home Affordable Refinance Program (HARP). These products help people who might otherwise struggle to qualify for a mortgage, especially in tighter credit markets. The impact on the U.S. housing market, the overall health of home sales, prices, and construction activity is significant—when Fannie Mae eases financing, sales tend to rise and home prices stabilize.

All of these pieces—securitization, competition with Freddie Mac, FHFA oversight, and borrower‑focused loan programs—create a web of relationships that keep the housing finance system moving. Below you’ll find a range of recent stories that illustrate how Fannie Mae’s role intersects with everything from policy shifts to market trends, giving you a practical view of its ongoing influence.

Trump urges Fannie Mae and Freddie Mac, led by Bill Pulte, to push big builders to develop 2 million idle lots amid a deepening housing shortage.